Start-up Dives - Wealthsimple Update

Simplifying investing, managing your money and Taxes

👋🏼 Hello! Welcome to Start-up Dives.

If this is your first time here, welcome!🙂 And, if you haven’t subscribed, please consider doing that to receive my notes on a Canadian business directly in your inbox each month.

I would also appreciate it if you could share this newsletter in your network or on social media.

Two personal updates…I am a new Dad and I got promoted at work 🎉 🚀

I took a little parental leave and have been buying baby stuff that I never knew existed all this while. That got me thinking about all the amazing Canadian startups capturing the baby market….but for now in this edition of Startup Dives, I will be building on top of my previous writeup on Wealthsimple. Read the full version here.

They are a Toronto based startup, on a mission to build the world's most human financial company. They have consistently been named as a top Canadian startup and have also been christened as one of the most innovative companies by Fast Company.

In this edition, I want to highlight two product features that WS has added to monetize Wealthsimple Tax and Wealthsimple Trade.

Wealthsimple Tax

Taxes are tough and nobody gets excited about them.

Here’s what I wrote around the same time last year about Wealthsimple’s acquisition of Simpletax.

Wealthsimple acquired tax software company Simpletax in September 2019. It’s Wealthsimple’s first foray outside of saving and investing but aligns well with their goal of providing solutions to improve overall financial health of their customers. If you are a WS customer, you no longer have to leave the WS family to do your taxes. Here’s what Simple tax says about their pricing:

After you submit your return to the CRA, we'll ask if you'd like to support SimpleTax. You can pay what you want, including zero. While we hope you'll support us if you can afford it, the choice is yours.

That’s actually what it is. You pay what you believe the service is worth. Pretty insane right? Here’s what some Reddit users have to say about it. I suspect that they are likely making less money than what they could have with a fixed fee structure as observed with many pay as you want restaurants. Read here and here. However, they are definitely gaining ardent followers who would talk about their software to anybody and everybody that they know of. Only WS knows how much revenue is the service generating though.

Now we know how Wealthsimple is monetizing SimpleTax by adding a premium paid feature that is dealing with the CRA.

Anyone filing taxes in Canada can be audited by the CRA. Nobody wants to be in that situation because dealing with taxman is a headache.

Wealthsimple’s new feature is essentially an insurance that if you file taxes using SimpleTax and get audited by the CRA, Wealthsimple will provide you premium support with answering to the CRA. You can buy this insurance for $30. The paid feature shows up with its sales pitch right before you are submitting your taxes using Wealthsimple Tax. I found this as a brilliant way to monetize the product without losing its initial pricing strategy i.e. you file your tax returns for Free and if you like the product pay whatever you want for it. It is also incredibly smart because most people who buy this insurance will never actually end up using it. So WS is selling a service that it won’t even have to provide to a majority of folks who are willingly paying for it. 😎

Wealthsimple Trade

I wrote the following about Trade last year:

Wealthsimple Trade lets you buy and sell stocks and exchange-traded funds (ETFs) on major Canadian and U.S. exchanges without charging any commission fees that are typically associated with stock brokerages. They make money on currency exchanges for US trades through a currency exchange fee of + 1.5%. Their income is therefore dependent on the volume of US trades. I suspect they would hardly be making any money on ‘Trade’ at this point unless they come up with premium plans in the future.

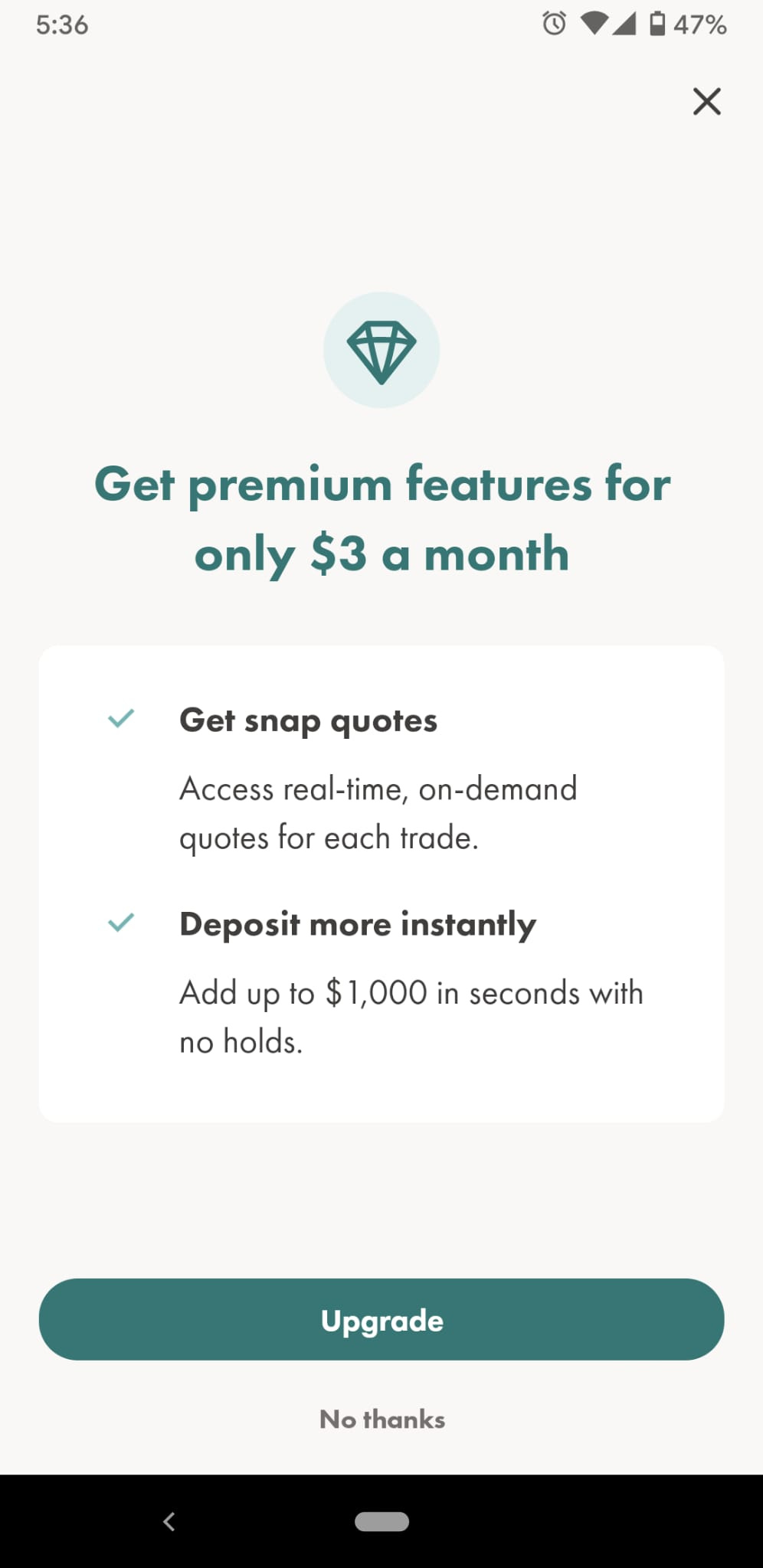

They now have a premium plan as expected.

This one is really interesting because WS is selling features that are usually baked in for free by other brokerages. But then, Wealthsimple Trade is the only commission-free trading platform in Canada. Most of its competitors charge a minimum of $4.95 and up to $9.95 (or more) per trade. WS’s strategy is recurring revenue independent of trade volume. $3/month seems like a pretty reasonable fee for instant deposits and real-time data. However, there are a couple things to consider:

For a lot of folks, Wealthsimple Trade is there to invest in ETFs because it is absolutely free. Those folks really don’t need these features. I suspect that will be the case for a huge majority of folks right now.

WS doesn’t have the ability to hold USD at the moment. However, the moment they add native USD accounts, these paid features will likely have a lot of takers.

I predict that adding USD accounts would likely be the next big thing on their roadmap. I am looking forward to that day :)

An ask

I would love to hear what you think of Start-up Dives and what kind of content you would like to see in the future. I would appreciate if you can give me the gift of feedback by filling this 2 min survey.

That’s all for now :)

Thanks again for subscribing to Start-up Dives! If you, in the spirit of sharing & learning, would like to share this newsletter with a friend, you can forward it or suggest they sign-up here.